By

Scott B. MacDonald

Summer

is over and it is time to go back to work. We think that September

is going to be a good month for the equity and corporate bond

markets. The bulls clearly want to run. Despite the summer meltdown

in U.S. Treasuries, the power blackout and the vacation season,

corporate bond spreads were driven tighter in August by a combination

of good economic news, the possibility that the new bond issue

pipeline could be relatively light due to incrementally higher

borrowing costs and the absence of any major negative geo-political

news. This combination also proved to be a tonic for the stock

market, with the Dow consistently staying above the 9,000 mark

for several months now – and recently even surpassing 9,500.

The NASDAQ has also perked along, reflecting renewed investor

interest in technology. Equally significant, the IPO market is

beginning to show signs of life. According to Bloomberg, IPOs

over the last two months totaled $10 billion, four times the first

quarter of 2003 and higher than the $9.1 billion seen in the second

quarter. We expect these trends to continue through the fall --

possibly into next year. At the same time, we also see a lot of

things that remain problematic and portend tough challenges later

in 2004.

Summer

is over and it is time to go back to work. We think that September

is going to be a good month for the equity and corporate bond

markets. The bulls clearly want to run. Despite the summer meltdown

in U.S. Treasuries, the power blackout and the vacation season,

corporate bond spreads were driven tighter in August by a combination

of good economic news, the possibility that the new bond issue

pipeline could be relatively light due to incrementally higher

borrowing costs and the absence of any major negative geo-political

news. This combination also proved to be a tonic for the stock

market, with the Dow consistently staying above the 9,000 mark

for several months now – and recently even surpassing 9,500.

The NASDAQ has also perked along, reflecting renewed investor

interest in technology. Equally significant, the IPO market is

beginning to show signs of life. According to Bloomberg, IPOs

over the last two months totaled $10 billion, four times the first

quarter of 2003 and higher than the $9.1 billion seen in the second

quarter. We expect these trends to continue through the fall --

possibly into next year. At the same time, we also see a lot of

things that remain problematic and portend tough challenges later

in 2004.

First, at least on the surface, the outlook for the U.S. economy

is looking better. Durable goods orders are up; new home sales

reached their second highest level in history during July and

early August; and manufacturing in August expanded at the strongest

pace in eight months. Inventories are also being depleted at a

faster pace than earlier thought. Even global semiconductor sales

are up, rising 10.5% in July, the fifth straight monthly gain.

All of this is reflected in GDP numbers: real GDP for Q2 was revised

from 2.4% to 3.1%, well above consensus. We think real GDP will

be in the 3.6% range for the rest of the year, moving our estimate

of growth from 2.4-2.6% to around 3%. There is something to be

said about pumping liquidity into the system. Even the World Bank

is more bullish, looking to stronger growth next year based on

a revival of world trade, stronger domestic demand in most countries

and an ebbing of international tensions.

In addition to more positive economic data, the geo-political

environment – while remaining fraught with peril – has

not heated up to the point that it is disturbing the fervor of

investors who remain intent on bidding up equities – which

continue to trade at historically high valuations. Yes, terrorist

attacks are occurring in Southeast Asia and the Middle East, and

North Korea remains a challenge. However, negotiations with North

Korea continue, key Islamic radicals were arrested in Southeast

Asia and Saudi Arabia, and some form of Israeli-Palestinian dialogue

continues. We also expect the United Nations will eventually assume

a greater role in Iraq, which could help to stabilize the situation.

From equity and corporate bond market standpoints, the improvement

in economic data and a perceived reduction in international tensions

are sending the signal that the recovery is sustainable.

Nevertheless, while we think that economic growth has room to

run, not everything is positive. For a full-fledged recovery we

still need to see sustainable gains on the employment front. We

take note of a recent statement by the National Association of

Manufacturing that the recovery for U.S. manufacturers is "the

slowest on record since the Federal Reserve began tracking industrial

production back in 1919." Some 2.7 million manufacturing

jobs were lost over the past 36 months. What is needed to reduce

unemployment and stabilize manufacturing employment is a long

awaited and still anemic return of capital spending. If this occurs

during Q3, the recovery could gain further momentum in Q4 and

2004. In addition, the U.S. deficit is heading into record numbers.

While this is not a concern in the short-term, it could have long-term

consequences, especially if measures are not taken to deal with

the situation.

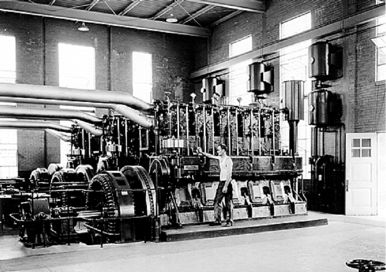

There

is also the issue of the state of U.S. utilities. The August power

outage that hit the United States and Canada was a major shock

to the American public and demonstrated that the North American

utility sector has problems. In fact, the blackout indicated that

the U.S. system of regulating utilities, a mix of feudal-like

local authorities and a less than forceful federal regular, the

FERC, combined with some poor management teams sprinkled across

the country, is dangerously offline. The result was that billions

of dollars of business was lost, either in closed restaurants,

spoiled grocery store goods or powerless factories. Idle factories

do not produce durable goods. It is now estimated that $60-100

billion is needed to upgrade the U.S. utility system.

There

is also the issue of the state of U.S. utilities. The August power

outage that hit the United States and Canada was a major shock

to the American public and demonstrated that the North American

utility sector has problems. In fact, the blackout indicated that

the U.S. system of regulating utilities, a mix of feudal-like

local authorities and a less than forceful federal regular, the

FERC, combined with some poor management teams sprinkled across

the country, is dangerously offline. The result was that billions

of dollars of business was lost, either in closed restaurants,

spoiled grocery store goods or powerless factories. Idle factories

do not produce durable goods. It is now estimated that $60-100

billion is needed to upgrade the U.S. utility system.

While everyone agrees the system is in need of repair, consensus

ends when it comes to who should pay and want kind of system is

required. For much of the U.S., utility industry times are hard.

Many of the companies already have large debt loads, are cutting

costs, and selling non-core assets. Rating agencies have been

bearish. While these same companies often purchase energy on deregulated

markets, they sell power at controlled prices (and are unable

to pass on any price increases). Local political establishments

are active in protecting the consumer. Consequently, Washington

has the potential to be a gridlock on utility reform – with

the Democrats declaring that the Republicans are in the pocket

of greedy utility companies and want to pass reform legislation

that will open up federally protected lands to oil and gas exploration.

For their part, the Republicans are grousing that the Democrats

want state intervention and control – basically a socialist

approach to an already troubled industry. To some extent both

sides are right. Therefore, we expect a lot of talk over the utility

industry in the months to come, but real action with big price

tags will be slow. In this case talk is indeed cheap – at

least until the next power outage.

Despite the concerns over unemployment (still in the 6% area),

growing budget deficits, and potential energy problems, the Bush

administration is geared on pushing enough liquidity into the

system to make certain the recovery gets its feet and moves –

at least until the November presidential election. As we have

stated all along, the impact of the federal government pumping

billions of dollars into the economy will stimulate growth. The

trick is to have enough stimuli to allow the consumer an opportunity

to consolidate debt and rebuild savings, which must be balanced

with renewed capital spending. The latter is beginning to happen

very gradually. For the Bush administration the bottom line is

to grow the economy and win re-election. Beyond that policy priorities

are focused on the war against international terrorism and stabilizing

Iraq. Dealing with the federal deficit is a low priority, though

this could become a major drag to the economy in the medium to

long term. However, the Bush administration’s request for

emergency spending of $87 billion to finance operations in Afghanistan

and Iraq and the probability that the budget deficit could be

equal to 4.7% of GDP, are not positive signals on fiscal management.

This puts the upcoming fiscal deficits in the same ball park as

the record fiscal deficits of the early 1980s. Fiscal prudence

is being sacrificed for political expedience.

The bottom line is we are constructive on both the equity and

corporate bond markets in the short term. For the latter the probable

scenario is one shaped by generally tighter spreads, a modest

new issue pipeline, and generally positive economic headlines.

Although some companies have probably opted not to go to the market

to issue debt due to slightly higher rates, we think that rates

remain historically low and are likely to go up as the year continues.

While the improving economy is likely to pull money out of the

bond market and into equities, there will still be enough money

in bonds to make September a positive month for bond market returns.

As for the stock market, the bulls want to run and they will in

the short term. If the momentum continues through September and

sentiment becomes firmer in the belief of a sustainable recovery,

the bulls could continue to run through the end of 2003 and 2004.

By early 2004, the main concern for economic policymakers will

no longer be deflation, but the possibility of looming inflation.

Indeed, in 2004 the U.S. economy could be heading into a period

of stagflation, in which a rising fiscal deficit and rising prices

are matched by little or no growth in the employment area. Consequently,

we say ”Viva los toros!” ; at least for now.