By

Bill Powers, Editor, Canadian Energy Viewpoint

When

I was in Calgary last year visiting several oil and gas

companies, the CEO of one of Canada’s best run

junior oil and gas companies looked across the conference

table and said something that stuck in my mind: “Get

ready for $50 oil!” Such a bold prediction, made

when nearly every Wall Street and Bay Street analyst

was lowering his 2004 oil price prediction, underscores

the massive divide in opinion on the future price of

oil.

There is a growing belief among the geologists who study world oil supply

that world oil production is soon headed into an irreversible decline. The

geologist who has most eloquently laid out the argument for higher oil prices

is Dr. Colin J. Campbell. Dr. Campbell, author of the book “The Coming

Oil Crisis,” holds a doctorate from Oxford University and spent decades

working as an international exploration geologist for major oil companies.

After a long career in the oil industry, Dr. Campbell worked for Petroconsultants,

based in Geneva, Switzerland. At Petroconsultants, he was instrumental in

assembling what has become widely recognized as the world’s leading

hydrocarbon database. Dr. Campbell is now a Trustee of the Oil Depletion

Analysis Centre ("ODAC"), a charitable organization in London that

is dedicated to researching the date and impact of the peak and decline of

world oil production due to resource constraints, and raising awareness of

the serious consequences.

I found Dr. Campbell’s thesis on the future of world oil production

in a speech he gave to a German university in 2000 entitled “Peak Oil:

A Turning Point for Mankind”. (To watch a replay of this speech go

to the following URL: http://www.globalpublicmedia.com/SECTIONS/ENERGY/oil.depletion.php and

click on the RealVideo presentation. The beginning of the lecture might be

a little blurry.) Below is a summary of his findings.

Dr. Campbell believes worldwide production of conventional oil will head

into permanent and irreversible decline in the 2005 to 2010 timeframe.

The term “conventional oil” is used to refer to oil that is produced

from conventional reservoirs and does not include oil from tar sands, polar

areas, deepwater areas or oil from coal or shale. Conventional oil accounts

for 95% of all oil produced today and will remain the determining factor

in world production for the foreseeable future. According to Dr. Campbell,

world oil discovery peaked in the 1960’s and has declined steadily

since. We are now to a point where we produce four barrels for every one

we discover. Clearly, this is an unsustainable situation since long-term

discovery and production must mirror each other to some degree.

Dr. Campbell is also far from sanguine about the current state of world oil

reserves. He provides significant evidence that oil reserves are being grossly

overstated by OPEC. Dr. Campbell notes that the two most used estimates of

world oil reserves, which are prepared by the Oil and Gas Journal and the

BP Statistical Review, are flawed. Both publications rely on reserve estimates

provided to them by governments and industry and make no effort to verify

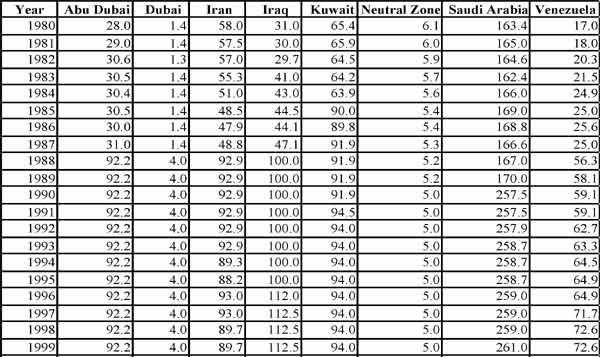

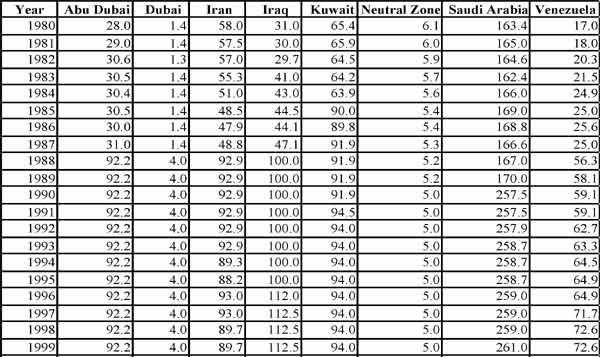

accuracy. The below table (data from the Oil and Gas Journal) supports Campbell’s

view that OPEC’s reserve figures are not based on any reliable estimate

of total recoverable reserves. Notice how several countries report the same

reserve figures for several consecutive years. Constant reserves figures

are very unlikely considering that production and discovery would have to

match each other exactly.

OPEC Reserves (In Billion Barrels)

|

Global

Credit Solutions Limited provides a top-level service

in the collection of commercial and consumer accounts,

skip tracing, asset and fraud investigations and

credit information on companies and individuals,

globally. Visit them on the web at http://www.gcs-group.com or

join their free monthly newsletter specially designed

for credit professional and managers. |

Campbell

contends that OPEC reserve estimates are politically

motivated. Kuwait is an excellent example of what is

wrong with the way OPEC countries report reserves. The

country reported a gradual decline in its reserve base

from 1980 to 1984. This should be expected from a mature

producing country. However, in 1985 the country reported

a 50% increase in reserves with no corresponding discovery.

The Kuwaiti government increased its reserve estimate

due to the implementation of an OPEC production quota

system that set country production levels based on country

reserves. Kuwait was not alone in increasing its reserve

estimates for political reasons. In 1988, Abu Dubai,

Dubai, Iran and Iraq all significantly increased their

reported reserves for political reasons. Even OPEC heavyweight

Saudi Arabia reported a massive increase in reserve estimates

in 1990 for similar reasons.

While OPEC has consistently overstated their reserves, Campbell contends

that industry has understated its reserves. The pressure on companies to

understate reserves by the analyst community has created a gross misunderstanding

of how much oil is actually being discovered. Campbell argues that most company

estimates create the illusion of growing reserves when in fact; previously

discovered oil is merely being reclassified into the proven category for

reporting purposes.

[Note: At least one major oil company is not understating reserves. Royal

Dutch/Shell (NYSE:RD) reported a whopper of a reserve write down in January.

The company reported that its reserves were overstated by an incredible 20%.

The company contends that it acted “in good faith” when preparing

its reserve estimates. Such a large write down has attracted the attention

of SEC Commissioner Roel Campos, who is considering launching an investigation

into the matter].

According to Dr. Campbell, we are likely to face a sea change in the world’s

oil production capacity. Campbell maintains that peak production comes close

to the midpoint of depletion. According to Dr. Campbell’s estimate

of the world’s oil endowment, we are right at the halfway mark.

How might this crisis unfold? Dr. Campbell makes it clear that the crisis

will not look anything like the oil price shocks of the 1970’s. Instead,

Campbell refers to those politically motivated disruptions in supply as merely “tremors” compared

to the “earthquake” that is about to hit the oil consuming world.

The first phase of the crisis, which has already arrived, will bring about

price shocks. In the nearly three years since Dr. Campbell made this prediction,

the world has witnessed several rounds of high oil prices. However, the onset

of chronic shortages will begin around 2010 when the Middle East will be

required to supply 50% of total worldwide oil production. More importantly,

it is at this time the Middle East will have reached its production midpoint

and will head into decline also.

Clearly the scenario laid out by Dr. Campbell is not a pretty one. However

in every crisis lies opportunity. Astute investors should recognize the implications

of declining worldwide oil production and adjust their portfolios accordingly.