By

Michael McGaughy, East Bridge Advisors

SAN FRANCISCO (KWR) -- August 4, 2005 -- Perhaps the

simplest and most direct exposure US investors

can have to China’s equity markets is the

iShares FTSE/Xinhua China 25 Index Fund (NYSE:

FXI). The fund tracks the performance of the

similarly named FTSE/Xinhua China 25 Index, and

provides exposure to the largest and most liquid

Mainland China stocks available to non-PRC citizens.

All companies’ have their primary or secondary

listing in Hong Kong and 17 also have US listed

ADRs. The top ten companies account for 61% of

the index.

The fund’s annual management fee is 0.74%. This

is less than the 2% or higher fees for alternatives,

such as actively managed Emerging Markets, Asian and

Greater China funds, which typically provide less direct

exposure to the Mainland. Additionally there are no 12b-1

fees or other associated expenses beside brokerage.

The fund is managed by Barclays Global Investors, the

world’s largest manager of ETFs. It was launched

in October 2004 and presently has over US$900m in assets.

Liquidity is good with an average daily trading volume

of over US$8m. Put and call options are available. The

index is reviewed and rebalanced quarterly to keep constituent

companies below 10% of overall net asset value. For instance

at the end of July, the fund’s holding of China

Mobile decreased to 9.9% of the fund’s net assets

from 10.9%.

Dividends of the underlying companies flow through to

the fund’s shareholders and are paid once per year

(2005 ex-date is 23 December). The fund has not paid

any dividends since being listed, which according to

iShares professionals, is due to the newness of the fund.

Recent performance has been good with the fund's price

hitting new highs since its October 2002 launch. Most

of index’s

constituents are trading closer to their 52-week highs

than their 52-week lows.

The index and fund provide good exposure to the Mainland,

with virtually all companies’ earnings directly

tied to China’s economic growth and most companies

will be net beneficiaries of any further Rmb appreciation.

One standout, BOC HK is the Hong Kong subsidiary of one

of the Mainland’s largest banks, Bank of China,

and does virtually all its business in Hong Kong despite

its name. Other companies with significant non-China

operations include China Resources with 49% of sales

from outside the Mainland, and Citic-Pacific with 41%

of its turnover coming from HK.

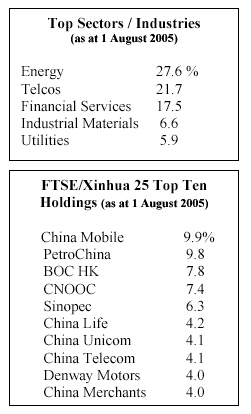

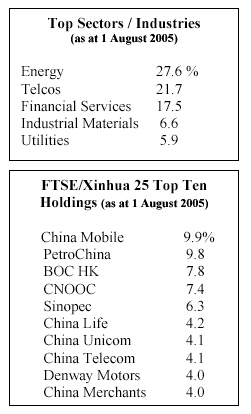

The fund also provides good exposure to sectors that

most institutions typically look at to invest in a country’s

overall growth – energy (28% of the fund), Telcos

(22%) financial services (18%), industrial materials

(7%) and utilities (6%).

Valuation

The index appears to be inexpensive compared to interest rates. Based on sell-side

analysts’ EPS forecasts and August 1 prices, the fund’s constituent

stocks are trading at a weighted average P/E of 12.8x 2005 earnings. This equates

to an earnings yield of 7.8%, about 300 bp more than the 4.78% yield on the US$

China BBB+ bond.

The index appears to be inexpensive compared to interest rates. Based on sell-side

analysts’ EPS forecasts and August 1 prices, the fund’s constituent

stocks are trading at a weighted average P/E of 12.8x 2005 earnings. This equates

to an earnings yield of 7.8%, about 300 bp more than the 4.78% yield on the US$

China BBB+ bond.

Earnings growth is expected to be modest. Weighted average EPS is expected to

increase by 8.8% in 2005 and 5.3% in 2006. The decrease in growth is in line

with the forecasted slowing of the Chinese economy in 2006.

Dividend yield is attractive compared to local HK based deposit rates. Based

on the sell-side’s DPS forecasts (1), the fund’s constituent stocks

are expected to produce a weighted average dividend yield of 3.3% in 2005 and

3.5%

in 2006. While not as much as US$ deposits in the US, it is significantly higher

then interest rates on US$10,000 equivalent 6-month Rmb, HK$ and US$ money market

deposits in Hong Kong of 0.70%, 1.60%, and 1.10% respectively.

The market is expecting a hefty increase in dividends, but is pricing in decreasing

cash flow. Applying a simple dividend discount model to all constituent companies,

at an assumed 12% discount rate, the market is pricing in a perpetual dividend

growth of 8.3%. On a discounted cash flow basis, and an assumed WACC of 12% the

market is pricing in a perpetual cash flow decrease of 3.9%.

The last point is particularly interesting as analysts are forecasting that weighted

average cash flow per share will increase by 14% in 2005 and 7% in 2006, and

that weighted average cash flow yield is expected to increase to 15.2% in 2006

from last year’s 12.9%.

Another significant point is that the sell-side is expecting the fund’s

underlying companies’ weighted average payout ratio to increase to 40.1%

in 2006 from 38.5% last year. Increasing payout ratios tend to be double signaling

events implying a higher long-term level of expected earnings and improved corporate

governance, as evidenced by managements’ willingness to return cash to

shareholders. This is consistent with China’s long-term movement toward

allowing state owned companies to operate as on-going commercial concerns. With

average state ownership at about 65% or more for China’s listed companies,

high dividend payouts also provide their state-owned parents with steady cash

flow.

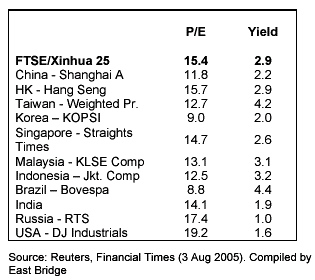

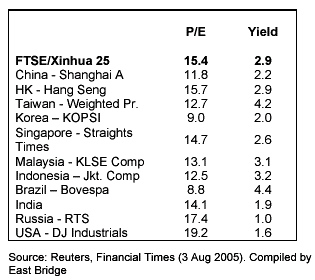

On a P/E basis, at 15.4x 2004 earnings the valuation of the fund’s constituent

stocks is higher than other commonly quoted regional and emerging markets indexes.

It is dearer than the main indexes used to track the markets in Shanghai, Taiwan,

Korea, India and Brazil, but less expensive than Russia and the US and in line

with Hong Kong.

On a P/E basis, at 15.4x 2004 earnings the valuation of the fund’s constituent

stocks is higher than other commonly quoted regional and emerging markets indexes.

It is dearer than the main indexes used to track the markets in Shanghai, Taiwan,

Korea, India and Brazil, but less expensive than Russia and the US and in line

with Hong Kong.

Dividend yield is arguably a better valuation measure due to different regional

and corporate reporting and policies that make cross border earnings, and hence

P/E ratios, difficult to compare. On a historic yield the FTSE/Xinhua’s

constituent stocks are in the mid-range of several widely quoted emerging markets.

It has a higher historic yield than Korea, Singapore, and India, but less than

Taiwan and Brazil. Based on current prices, its yield was largely in line with

the Shanghai A-Share market, Hong Kong, and Malaysia.

Disclosure: The author of this article owns shares in the iShares FTSE/Xinhua

China 25 Index Fund.

(1) All

FTSE/Xinhua constituent companies are actively followed

by institutional analysts, mostly based in Hong Kong,

with some based in Shanghai. Earnings estimates and dividend

forecasts used as a basis for this article are for 2005

and 2006 and come from Reuters compiled data using Hong

Kong GAAP based estimates.

This

investment profile is not intended

as investment advice or as an offer

or solicitation with respect to the

purchase or sale of this or any other

security. While the information contained

within is believed to be accurate,

it should not be construed as offering

a guarantee as to the accuracy or completeness

of the information contained herein

and should be checked independently

by the reader before it is used to

make any business or investment decision.

All opinions and estimates included

are subject to change without notice

and the author as well as KWR International,

Inc. staff, consultants and other newsletter

contributors to the KWR International

may or may not have a long or short

position in any security or option

mentioned within this article or any

other information published by KWR

International, Inc.

The index appears to be inexpensive compared to interest rates. Based on sell-side

analysts’ EPS forecasts and August 1 prices, the fund’s constituent

stocks are trading at a weighted average P/E of 12.8x 2005 earnings. This equates

to an earnings yield of 7.8%, about 300 bp more than the 4.78% yield on the US$

China BBB+ bond.

The index appears to be inexpensive compared to interest rates. Based on sell-side

analysts’ EPS forecasts and August 1 prices, the fund’s constituent

stocks are trading at a weighted average P/E of 12.8x 2005 earnings. This equates

to an earnings yield of 7.8%, about 300 bp more than the 4.78% yield on the US$

China BBB+ bond. On a P/E basis, at 15.4x 2004 earnings the valuation of the fund’s constituent

stocks is higher than other commonly quoted regional and emerging markets indexes.

It is dearer than the main indexes used to track the markets in Shanghai, Taiwan,

Korea, India and Brazil, but less expensive than Russia and the US and in line

with Hong Kong.

On a P/E basis, at 15.4x 2004 earnings the valuation of the fund’s constituent

stocks is higher than other commonly quoted regional and emerging markets indexes.

It is dearer than the main indexes used to track the markets in Shanghai, Taiwan,

Korea, India and Brazil, but less expensive than Russia and the US and in line

with Hong Kong.