| Focus: Economic Recovery | |

| JETRO,

1221 Avenue of the Americas, NYC, NY 10020 |

|

|

|

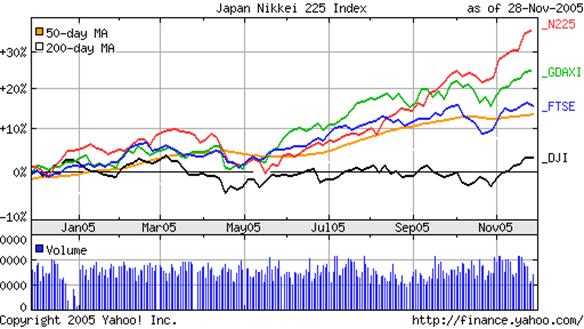

Back in the dark days following the 1997/1998 Asian financial crisis, Japan was mired in recession. It was just beginning to put into place the guidelines and reforms that are giving strength to the economic recovery now taking hold. At the time there was substantial talk about whether Japan and a troubled Europe could regain their strength as “global economic locomotives” or whether the US would be left to carry the load on its own. Today, however, macroeconomic, corporate, and political developments all suggest Japan is back on track and proceeding in the right direction. Business investment is surging. Employment is growing and the Japanese consumers finally appear to be re-opening their wallets. These factors are fueling higher economic growth and reducing Japan’s dependence on exports and government spending. This heightened activity, combined with Japan’s increasing receptiveness to imports, is also providing Asia and other export-oriented markets, with potential alternatives to their traditional reliance on sales to the US. While it should be remembered that Japan’s economic recovery is still in a formative stage, corporate and portfolio investors have begun to take notice. The nation has attracted substantial capital and direct investment inflows in recent years. In 2004 inbound foreign direct investment exceeded Japanese investments abroad for the first time and last week the Nikkei 225 index recorded its highest price level in over five years. When one takes note of these and many other positive indicators, there is substantial reason for optimism as well as a belief that the Japanese locomotive has left the station -- and may soon again begin rolling down the tracks. The Japan External Trade Organization (JETRO) provides the following information, which examines these issues, and other relevant developments, in greater detail. |

|

|

|

|

Following the collapse of Japan’s bubble economy in the early 1990s, however, the nation found itself in the midst of a protracted economic recession. At the same time Europe was also going through a weak phase. Neither was able to carry its weight and when the Asian financial crisis hit in 1997, there was real concern about how long the US could carry the load without help from these two major economies. Today one rarely hears talk about economic locomotives -- but many analysts have begun to wonder about the fate of the global economy in the event an economic slowdown occurs in the US. Given the reliance on exports of most Asian and other emerging market economies, this is a real concern. Businesses and investors fear if the US catches a cold, Asia and the rest of the world will catch a fever. Given these concerns, it is notable that several months ago, Morgan Stanley China analyst Andy Xie expressed in a report his belief that the potential for a domestically-led recovery in Japan may contribute to autonomous demand that is independent of US economic activity for the first time since 1991. Xie notes “the US economy could be weak next year, as the Fed keeps raising interest rates, which could deflate the US housing market and keep US consumption subdued. If Japan could partly offset the impact of a US downturn, it would be a stabilizing factor for Asia …. Last year, Japan ran a record trade surplus with developing Asia (63% of Japan’s trade surplus). This surplus is down by 20% in 2005. It is possible that, if Japan’s recovery holds, its surplus with developing Asia may fall a further 20% next year. Indeed, I see a possibility that Japan could run trade deficits with developing Asia in two years, continuing the pattern of richer nations importing capital from poorer nations.” This sentiment is given further credence by Goldman Sachs economist Kim Sun Bae, who argues that Japan will support perhaps as much of 1.7 percentage points of growth in the Asia-Pacific region by importing goods, bolstering the prices of manufactured goods, and investing in the region. While it is too early to proclaim Asia and other export-oriented regions to be independent of their traditionally strong correlation with Wall Street and the US real economy, it should be noted the trend is moving in that direction. At present, Asia and other emerging markets now represent the primary source of incremental growth in many consumer, industrial and commodity markets and there is no reason to believe this trend will not accelerate in coming years. |

|

|

|

|

Exports to the United States, China, and other Asian countries, which totaled $51 billion in September (an 8.8% increase) contributed meaningfully to second and third quarter growth. However -- what is exciting observers of Japan’s recent economic success is not its export performance -- but rather the expanding number of pillars, which demonstrate diversified economic strength. As Atsushi Nakajima, chief economist with Mizuho’s Financial Group, commented “the recovery is expanding across the economy…It’s not just exports driving the economy anymore.” Analysts and economists have been according far more importance to consumer spending, supported by job growth and higher wages, and increased business spending. This differs greatly from the past when growth was driven almost solely by exports and government spending. As a result, it was highly encouraging that consumer spending surged by 2.4% in the second quarter and capital investment advanced 15.4%. In addition, eye-catching corporate investments abound. For instance, last August, Canon, the world’s large copier manufacturer, and Toshiba announced they would jointly invest ¥20.8 billion to start a research center for flat panel display technologies. Similarly, Komatsu, the second-biggest maker of construction equipment, said it would invest ¥30 billion to construct a mining and large pressing machine plant.

While consumers tempered their spending somewhat in the third quarter -- augmenting their expenditures by only 0.3% -- unemployment dropped to a seven-year low. Equally important, businesses continued to spend heavily, bolstering their investments by 0.7%. Further encouragement vis-à-vis business investment was found in increases in the Tankan survey of business sentiment in August and September. Deputy Director of the IMF’s Asia and Pacific Department Daniel Citrin observes that business investment has been invaluable for Japan since it has yielded “stronger consumer sentiment; improved employment…and much stronger underpinnings for the household sector and consumer demand.” Another positive development is signs of increased bank lending. Bank of Japan data released in September reveal that bank-lending in August rose for the first time in seven years. This was followed by another increase in September. The improvement stems from a dramatic reduction in non-performing loans (from ¥43 trillion in 2001 to under ¥20 trillion as of the end of 2004), better loan returns, and new revenue sources as banks increasingly seek out fee income. Commenting on the August increase in bank lending, Takahide Kiuchi, an economist at Nomura Securities noted this was “a clear sign the economic situation is improving.”

Source: Government of Japan |

|

|

|

Another potential cloud is Japan’s huge public deficits. Public spending, used in part to fight deflation, and stagnant or declining Japanese growth, caused Japan’s debt/GDP level to soar from 60% in 1990 to 160% today. Japan’s ratios are four times the level of debt owed by the United States. The IMF’s view is that the Japanese government recognizes this problem. In addition, unlike in the US, where private sector savings is extremely low, Japan’s public deficit is comfortably backed and funded by domestic Yen-denominated private sector savings reserves, which are among the highest in the world. Even more important, however, is that fact that Japan’s government is moving to address this problem through spending reductions. It has already increased some taxes -- e.g., social security payroll taxes -- and rolled back some income-tax cuts enacted at the end of the last decade. The Japanese government aims to have tax receipts equal to spending on everything other than interest payments within seven to eight years. Government debt issuances already are decreasing, with bond issues falling from ¥36,600 billion to ¥34,500 billion, reducing debt issuance as a portion of spending from 44.6 to 41.8%. Beyond this, deflation while diminished, does remain an issue. For the past seven years, the prices of goods and services in Japan have dropped by an average of 0.4%, while property and stock prices fell 50% after Japan’s economic bubble burst. Deflation makes consumers unwilling to spend, hurts profits, restrains business investment, and diminishes the value of assets that secure bank loans. Indeed, in the view of Naoki Iizuka, chief economist at Dai-Ichi Life Research institute, “an end to deflation would strengthen the world’s second-largest economy and enable Japan to shoulder part of the burden” for global economic growth. Turning to this issue, the Bank of Japan has forecast an end to deflation by the end of the year. Governor Toshihiko Fukui observed that price stability “is getting pretty close.” While there are some skeptics such as James Montier of Dresdner Kleinwort Wasserstein, strategists with firms such as Mitsubishi UFJ are encouraging investors to buy bonds with shorter maturities in anticipation of a termination of the Japanese Central Bank’s zero interest rate policy (ZIRP). At this point, it is not clear exactly when the Bank of Japan will end ZIRP, but the key point is there are signs pointing to an end. This viewpoint is supported by good news with respect to property prices, which are demonstrating better performance in major metropolitan areas. To cite one anecdotal example, the Chief Executive of Mitsubishi Estate, Japan’s largest property developer, stated, with respect to Tokyo, that “the office vacancy rate is low, condominium sales are doing very well.” |

|

|

|

Purchases of consumer goods and services have been critical to Japan’s recent economic success and give further credence to the belief a sustainable recovery is underway. Similarly, as seen in the chart below, Japanese imports of goods and services as a percent of GDP has been rising quite dramatically in recent years. In the words of Graham Davis, director of the Economist Corporate Network in Tokyo, “the economy is in a very sweet spot at the moment where everything seems to be doing quite well. You can expect to see the domestic side of the economy and the service sector, which is so important, continuing to do quite well.” Growth in Japan’s consumer market creates a number of exciting opportunities for sellers of such goods. It also creates opportunities for them to invest in Japan. Wal-Mart recently affirmed its belief in Japan’s potential by spending $600 million to assume a 50% stake in Seiyu, a supermarket chain in which it already had a 42% stake. John Menzer, Chief Executive of Wal-Mart International, said this investment was designed to deepen “Wal-Mart’s presence in the second-largest retail market in the world.” There are also great opportunities for retailers in various niches such as the luxury sector (e.g., Louis Vuitton bags, Dom Perignon champagne, Tiffany jewelry, Bacarat crystal, etc.) and leisure products. While Japan has a population roughly half the size of the U.S., it has a luxury goods market that is twice the size. In remarks given to the Japan Society, Fashion Institute of Technology Professor Jeff Buchanan asserted “without Japan, it is safe to say the global luxury market would have ceased to exist as we know it.” Coach Japan, which began operations in Japan in 2001, already has 106 stores and generated slightly more than ¥39 billion in sales between July 2004 and June 2005. Japan is a suitable market for luxury and branded goods due to the tendency of distribution partners to adopt the long-term mentality necessary to build adequate recognition and positioning. It also possesses a far less fragmented media market, which introduces cost efficiencies into national advertising and marketing efforts. Japan consumers are also well known for their appreciation of, and willingness to pay for quality goods. Moving forward, many believe that opportunities in Japan’s retail market will continue to improve. This is true despite the nation’s low birthrate – a phenomenon that is at least partially caused by the large numbers of single-Japanese women entering the workforce. These women are enjoying greater independence and disposable incomes, and in the words of Goldman Sachs Japan Chief Strategist Kathy Matsui becoming, “a very important source of income and consumption growth.” The forthcoming retirement of many Japanese with substantial savings is also creating many additional opportunities for marketers of travel, leisure, and related services. While Japan’s $1.3 trillion retail market is huge, many believe services -- which accounts for 60% of the country’s output -- have even greater potential. August sales of software, computer system management and other information services rose by 1.4% and some analysts believe growth in the service sector will help Japan to achieve its fourth consecutive year of expansion. For example, in the area of mobile phones, there are many opportunities given Japan’s role as a trendsetter. Eurotechnology Japan K.K. reports that Japan is the first country with wallet phones on a big scale. It is also a leader in mobile commerce -- selling over $500 million a year in train tickets via mobile phone on one single train line -- and tallying extremely high levels of music downloads. Foreign investors may also wish to consider opportunities in health services as the aging of the Japanese population will create a greater need for medical and nursing care. According to Government of Japan statistics, the medical care market should grow over 30% over the course of this decade -- from roughly ¥56 trillion in 2000 to ¥75 trillion in 2010. The range of service investment opportunities in Japan also includes the environment. High energy prices, as well as efforts to minimize pollution, encourage recycling and reduce global warming have increased interest in this sector. This has created a demand for services including waste management, environmental R&D, alternative energy, organic and natural foods and other green-friendly technologies and products. The recycling area alone may approach ¥47.2 trillion in revenues by 2010. Finally, the area with perhaps the most potential is the area of financial services. The increasing emphasis on profitability among corporations who are much more apt to adopt US-style treasury management techniques and benchmarks, as well as the need to raise returns on pension funds and retail portfolios -- are just a few of the trends leading to increasing interest in a wide range of financial products. This also includes the alternative investment area, which has been enjoying dramatic growth in the US. Akira Takahasi, head of Credit Suisse First Boston’s Alternative Capital Division in Tokyo, for example, commented on the rise of Japanese hedge fund investments, stating, they had grown “at high speed” in 2003 and 2004. The Japanese government is also taking steps to encourage investment in the retail and service sectors. This includes regulatory reforms to facilitate foreign investment, tax breaks for capital investment, and support for hiring workers. For instance, the city of Yokohama will give foreign investors five years of property tax reductions provided certain investment conditions are met. Similarly, Hyogo Prefecture will provide up to ¥300 million yen to job-creating new ventures, with greater per employee subsidies, depending on the number of jobs that are created. |

|

|

|

Comparison: One Year Performance of Nikkei 225, Dow, FTSI and DAX Index What is also catching the attention of analysts are signs that Japanese investors are finally joining the foreign investors who have been the primary buyers in recent years. This is demonstrated by large increases in trading volumes by domestic investors and some movement away from the foreign treasury bills and securities that had been their primary focus toward Japanese equities. While this trend is still in its infancy, if it continues, and gains further strength through greater institutional and retail participation, it could have a dramatic effect on Japanese stock prices. Interest in Japan, though, goes far beyond financially-motivated investments made by fund managers. It is also manifest by inward FDI flows, which have reached new highs and, for the first time, exceeded outward FDI flows in 2004. Comparison of Inward and Outward Foreign Direct Investment Flows Between Japan and Other Markets  Source: Government of Japan

|

|

|

|

It is possible, or even probable, that an economic slowdown in the U.S. or China could limit the progress of Japan’s economic recovery. Yet not all investors believe a downtown in such markets would be devastating for Japan. In the October 20 issue of the Greed & fear newsletter, for example, CLSA analyst Christopher Wood argues, “A real slowdown in America may delay Japan’s move out of deflation. But it will not end it. The reason deflation is ending in Japan is because the country’s banking and property problems have been fixed. This benign trend has nothing to do with America or China.” The IMF, too, has noted that Japan’s economic situation this time is different because “finally, the excesses of the bubble period—excess labor, capital, and debt—have worked themselves out.” | |

Data,

statistics and the reference materials presented within this newsletter

have been compiled by JETRO from

publicly-released media and research accounts. Although

these statements are believed to be reliable, JETRO does not guarantee

their accuracy, and any such information should be checked independently

by the reader before they are used to make any business or investment

decision. |

|

| For additional information on economic

and financial trends in Japan, please contact Akihiro Tada, Executive

Director of JETRO NY at Tel: 212-997-0416, Fax: 212-997-0464, E-mail:

Akihiro_Tada@jetro.go.jp |

|

|

|

|

|

Focus is published and disseminated by JETRO New York in coordination with KWR International, Inc. JETRO New York is registered as an agent of the Japan External Trade Organization, Tokyo, Japan and KWR International, Inc. is registered on behalf of JETRO New York. This material is filed with the Department of Justice where the required registration statement is available for public viewing.

|

|