|

Overview of Global Steel Industry

By

Salman Anwar

SUMMARY:

- The increased level of volatility in the steel sector is related to industry consolidation, China’s expansion as a key player, and the business cycle.

- Industry consolidation: Major trend as companies have cash/industry is fragmented/new strategies needed to tap growth areas in emerging markets.

- The rise of China: China emerging both as a producer and consumer;

- Supply chaining: Companies in more mature industrial countries are increasingly forced to look to assets (and growth) by setting up production operations (steel factories) in key developing economies that places then close to natural resource supplies (both in terms of inputs and energy).

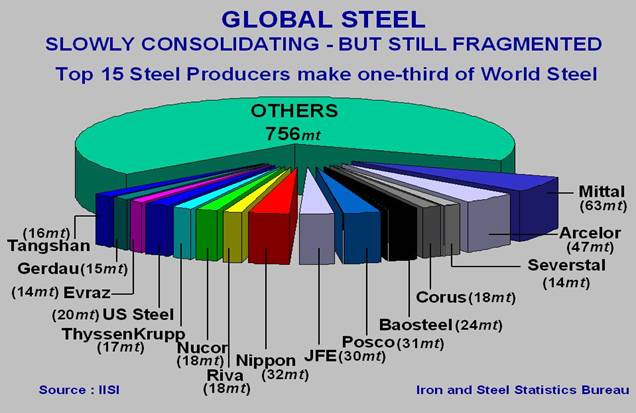

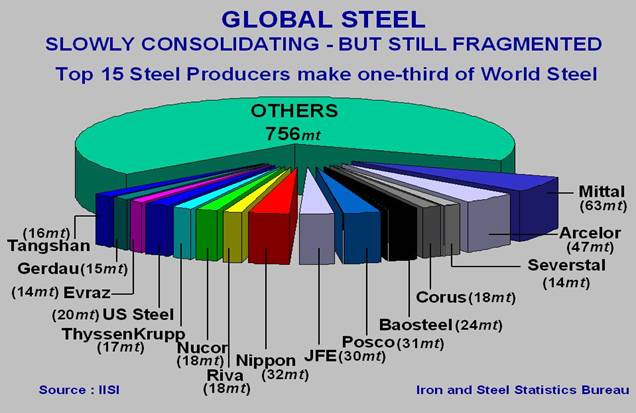

The global steel industry is highly cyclical, very competitive and still fragmented in terms of market share. Currently the industry is at the height of the business cycle and is going through a consolidation phase, which might result in the smaller players being acquired by the larger ones. The total output from the industry exceeds 1.4 billion tons in 2005, most of it augmented by the increase in output from China. This is expected to increase further, making steel output from China among the largest in the world.

The steel industry demonstrates a high degree of variability, both in terms of earnings and production. The factors attributable for driving this variability are global economic conditions with a particular sensitivity to the performance of the automotive, construction, capital goods and other industrial products industries. The commodity nature of steel, the producers and consumers limited control on price, and the demand and supply disparity have made steel prices volatile. Significant increases in prices for metals and energy over the past two years have also contributed to increased variability in the industry.

Consolidation:

On the consolidation front, the steel industry was focused on Mittal’s bid to gain control over Arcelor. As of July 2006, it appears that Mittal has won its takeover effect for Arcelor, after a protracted wooing. Mittal’s victory in the battle for global steel industry control is giving the steel industry a new direction. The world’s number one and two producers have combined and this will go a long way to push consolidation. The now combined Arcelor- Mittal would produce more 10 percent of the world output, close to 100 million tons of steel. This would give an increased pricing power for producers and suppliers, and decrease the fragmentation. We expect more M&A transactions to occur, with large players buying up the smaller players. Currently it appears to be that Arcelor laid its weapons, which were out before to defend itself from being acquired by Mittal, though Mittal has proven itself to be an earnest and hard-to-shake-off suitor.

Arcelor-Mittal have become the largest steelmaker in the world by turnover as well as by volume. In early 2006, Arcelor had contacted the Russian steel maker Severstal for a rival merger, in order to fend off Mittal’s hostile takeover bid, but it was unsuccessful in doing so. Alexey Mordashov, the owner of Severstal, reacted to the hostile takeover by marching back to Moscow, to wait and strike when the time is right. After the takeover, Mordashov stated: “Severstal is reviewing all its options”. This indicated that Severstal might fight Mittal, but no resistance was seen. Mordashov was planning to collaborate with Roman Abramovich (a wealthy Russian billionaire with diverse business interests) to raise his offer for Arcelor but decided to go back and conduct his business at Severstal. A possible candidate for Mordashov’s future take over bid would be Corus of UK. It can be envisaged that in the medium term that there will be a handful of companies that will control about 1/3 of the global steel production.

China:

China, as the world’s major producer and consumer, and has a considerable influence on the industry globally, but more sharply in Asia. China’s production figures, which now represents 30% of the world output, continues to grow actively, reaching 349mt in 2005 up a substantial 25% from the 2004 level. Inundation of certain steel products in China has sparked material declines in major product prices and thus pushing the industry towards being more cyclical. Consequentially, China has emerged as the key swing factor over the direction of the global market, linking the ups and downs of its economy to the fate of the steel industry.

As of FY’2005

Global Rank |

Company |

Production in FY'05 million tons |

Global Market Share % |

Country |

1 |

Mittal (Baa3/BBB+) |

63 |

5.56 |

Netherlands |

2 |

Arcelor (Baa2/BBB) |

47 |

4.15 |

Luxembourg |

3 |

Nippon (A1/BBB) |

32 |

2.82 |

Japan |

4 |

Posco (A2/A-) |

31 |

2.74 |

South Korea |

5 |

JFE (Baa1/BBB) |

30 |

2.65 |

Japan |

6 |

Baosteel (BBB+) |

24 |

2.12 |

China |

7 |

US Steel (Baa1/BB) |

20 |

1.77 |

United States |

8 |

Corus (B1/B+) |

18 |

1.59 |

United Kingdom |

9 |

Riva |

18 |

1.59 |

Italy |

10 |

Nucor (A1/A+) |

18 |

1.59 |

United States |

11 |

ThyssenKrupp (Baa2/BBB) |

17 |

1.50 |

Germany |

12 |

Tangshan |

16 |

1.41 |

China |

13 |

Gerdau (Baa1/BB+) |

15 |

1.32 |

Brazil |

14 |

Severstal (B2/B+) |

14 |

1.24 |

Russia |

15 |

Evraz (B2/BB-) |

14 |

1.24 |

Russia |

|

Others |

756 |

66.73 |

|

Source: |

Iron and Steel Statistics Bureau |

|

|

|

Brief Company Overviews

- Arcelor- Mittal: The five-month long duel between Rotterdam, Netherlands-based Mittal and Luxembourg-based Arcelor has concluded. Mittal’s unprecedented takeover victory in the battle for the global steel giant has brought the five-month battle to a halt, after the final shareholder approval. In the new Arcelor-Mittal combine the Mittal family collectively holds a 43.5 percent share. The new steel company will have about 334,000 employees’ world-wide, and revenues close to $70 billion. Arcelor-Mittal is now the best of both worlds. Arcelor is well-positioned in Western Europe and catering the high-grade auto and construction industry. Mittal with mills spread out through the four continents in low-cost locations such as Czech Republic, Mexico, and Kazakhstan, producing mostly basic steel products. Still there are things to be settled between Arcelor and Mittal. For example, the fate of the Canadian steel maker Dofasco acquired in April 2006 by Arcelor is yet to be decided.

Mittal’s aggressive business model has helped the company create a profitable enterprise in countries that were not regarded as obvious investment targets (such as Ukraine and Indonesia). It has track record of buying loss-making, bankrupt or under-producing steel companies, and turning them around by restructuring, cost cutting and layoffs, thereby creating leaner and more competitive operations. The company has production units in 17 countries, United States, Canada, China, Indonesia, Mexico, France, Germany, Poland, Romania, Algeria, South Africa, Czech Republic, Bosnia and Herzegovina, Republic of Macedonia, Trinidad and Tobago, Kazakhstan and Ukraine. In contrast, Arcelor holds front running positions in its main markets: automotive, construction, household appliances and packaging as well as general industry. Arcelor is the number one steel producer in Europe and Latin America. Taking advantage of its now dominant position, Arcelor-Mittal has ambitions to further expand internationally in order to take advantage of the growth potential of developing economies and offer technologically advanced steel solutions to its global customers.

Arcelor-Mittal is more than three times larger in terms of production of and revenue from steel, than its nearest rival Nippon Steel Corp. of Japan. The combined company will now have a significant advantage in setting prices and negotiating the terms of various contracts with key customers. The new steel industry titan will be better equipped to combat the volatile nature of the steel industry. This is due to the fact that it will have globally diversified operations and a diversified product line up giving it the power to negotiate with large customers Toyota.

There are heavy ratings pressures on the four companies involved in this long and intense courtship. Standard and Poor’s BBB+ Mittal Steel Co. N.V. has a negative outlook, though the rating is on credit watch negative due to remaining uncertainty pertaining to the final outcome of merger talks and concerns that the combined group’s financial profile would deteriorate. It is possible that Mittal’s credit rating could be lowered by one level. Less likely is a two-level downgrade. Arcelor’s ratings will eventually be the same as Mittal, which could see it drop to a low BBB.

Severstal was placed on credit watch due to the uncertainty of its merger with Arcelor. Due to no merger activity, Severstal is likely to remain at its current ratings. The fourth company involved in this M&A game was ThyssenKrupp AG, which has a deal with Mittal to buy Dofasco. The fate of Dofasco is yet undecided. In the event of ThyssenKrupp AG (BBB) acquiring Dofasco, there is a possible downgrade in credit ratings by one level to BBB-.

- Nippon Steel Corporation: Nippon Steel Corporation is Japan’s No. 1 steelmaker and the world’s third largest, in terms of crude steel production, with annual consolidated output of approximately 33 million tons. It is backed by a solid business franchise supported by diverse product lines with a focus on high value added products, outstanding product development capability, as well as a strong customer base. The Company has also secured a solid presence overseas, fueled by distinctive research and development capabilities and strategic alliances.

- Posco: The Pohang Iron and Steel Company based in Pohang, South Korea, it is one of the top steel producers. Posco operates two steel companies in South Korea, one in Pohang and the other in Gwangyang. In addition to this, Posco operates in a joint venture with US Steel with name of USS–Posco, located in Pittsburgh, California. In June 2005, Posco signed a memorandum of understanding with the State Government of Orissa, India and plans to invest $12 billion to construct a plant with four blast furnaces, an electricity plant, housing, and an annual production capacity of 12 million tons of steel and is expected to start production in 2010.

- Severstal: Severstal is the largest Russian steel producer, with 2005 annual steel production of 17.1 million tons. In addition, Severstal owns Severstal North America, the fifth largest integrated steel maker in the U.S. with 2005 production of 2.7 million tons, and Lucchini, Italy’s second largest steel group with 2005 production of 3.5 million tons. Severstal is one of the world’s lowest cost and most profitable steel producers, with 2005 EBITDA of approximately 150 euros per ton. Severstal-Resource, its own subsidiary owns 70 years of iron ore reserves and 84 years of coal reserves. 2005 revenue and EBITDA were approximately EUR1.12 billion and EUR506 million, respectively. Severstal-Resource produces coking coal, thermal coal, iron ore pellets and iron ore concentrate.

- Corus: Corus is a customer focused, innovative solutions driven company, which manufactures, processes and distributes metal products as well as providing design, technology and consultancy services. The company’s headquarters are in London, with four Divisions and operations worldwide. Corus ranks among the 10 largest steel producers in the world, with about 18 million tonnes of crude steel production in 2005. Activities include carbon steel production which a re 90% of sales and aluminum smelting, rolling, and extrusion 10% of sales. The group's main production bases are the U.K., The Netherlands, Sweden, Germany, France, Belgium, and the U.S. It is often spoken about as a possible takeover candidate.

Appendix: Global Steel Industry

The steel industry in the European Union 25 is structured differently than the steel industry in the United States. The key difference is the consolidation of the industry. Arcelor-Mittal, ThyssenKrupp, and Corus enjoy substantial market share in a largely consolidated market place.

The steel industry in the United States is completely different compared to other industries globally. US corporate bond issuers have a higher historical default rate than any other steel producer globally. This reflects highly leveraged capital structures of the US steel producers compared to the European counterparts who hold higher cash balances placing significant importance to a cautious approach to liquidity. The high default rate in the US steel industry can be attributed to an elevated level of shareholder pressure for high short-term returns, which then forces the management to deploy higher-risk strategies.

Oversupply in China, particularly in commodity based flat products and long products, and the inventory build-up in Asian countries, with consistent high input prices, are pressuring the region’s profitability and cash flow and thus contributing to the variability in the global steel industry. A new record high was set for world trade in steel, which grew 8% in 2005 to about 1.3 billion tons. The largest steel exporting countries in 2005 were EU 25 32.4 million tons, Japan 32 million tons, Russia 30.9 million tons, Ukraine 27.3 million tons and, entering the top 5 for the first time, China 27.4million tons up a solid 37 percent.

- The largest importing countries were China 275 million tons, the EU25 166 million tons and Japan 132 million tons.

- The major exporters of iron ore in 2005 were Australia 239 million tons and Brazil 224 million tons.

Imports into China increased by 32% in 2005, compared to 2004, imports into the EU and Japan actually fell by 2%. Imports into China from Australia in 2005 were 112million tons, an increase of 34million tons on 2004. Imports from India, at 68.5million tons, were up by 18million tons on 2004 which means that imports from India have increased tenfold since 1998. Imports into China from Brazil reached 55 million tons, and increase of 8 million tons. The break-up of Chinese imports by country of origin shows that Australia supplied 41%, India 25% and Brazil 20%, other countries such as South Africa contribute to the remaining 14%.

China: In 2005 steel production in China was 349 million tons up 25% from 2004. In comparison, production in 2004 was 280 million tons, 2003 was 222 million tons and 2002 182 million tons. Imports in 2005 fell 18% to 27.3 million tons from 33.2 million tons in 2004. Imports had previously risen significantly in 2003 to reach 43 million tons. Exports grew 36% in 2005 to reach 27 million tons compared with 20 million tons in 2004 and 8 million tons in 2003. Since September 2004 exports have exceeded imports to make China a net steel exporter although this was reversed from July. However, in December 2005, exports again exceeded imports. Real GDP in China is expected to be around 10 percent in 2006 and will most likely remain high in 2007 in the run-up to the 2008 Beijing Olympics, hence feeding demand.

China, which is a major producer and consumer globally, is a net exporter of steel and its increased supply of products might find its way to the North America markets. The sudden increase in steel imports form China is not only fueled by the Beijing Olympics scheduled for 2008, but also because of the increase in domestic demand for infrastructure ignited by the rapid industrialization in China. Currently there are numerous small local steel companies in China, and in our view the Chinese steel industry is ripe for a rapid consolidation phase. But again a lot of it depends on a positive balance of imports and exports maintained in the Chinese steel industry. After Beijing Olympics in 2008, there are prospects of a slow down in the industry do the over production in order to feed big Chinese appetite for steel.

United States: The US, which is traditionally a steel importer, recorded imports of 30.2 million tons in 2005 a drop of 8% on 2004. The key imported products were semis 6.3 million tons, hot rolled coil 3.7million tons, welded tubes 3.6million tons and wire rod 2.8million tons. Key supplying countries include the NAFTA members Canada 5.6million tons and Mexico 3.8 million tons followed by Brazil 2.4million tons and China 2.3 million tons. US steel mill exports in 2005 were 9.4million tons compared with 7.8miliion tons in 2004.

European Union 25: EU imports, after reaching their highest level ever in Q1 2005 at 8.7 million tons, fell back sharply in the second quarter to down to 7.7 million tons and also in quarter 3 down to 5.3 million tons. Hence in the first 9 months 2005 imports, at 21.7 million tons were 11% down on the same period 2004. Consequently, over the first 9 months the EU has resumed its position as a net steel exporter with a surplus of 2 million tons imports 21.7 million tons and exports 23.7 million tons. Key products imported by the EU include semis, hot rolled coil, wire rod, galvanized sheet, hr plates and CR sheet. Key import sources include Russia 3.9 million tons, Turkey 2.1 million tons, Ukraine 2.2 million tons, China 1.5 million tons, India 0.9 million tons and Brazil 1.1 million tons.

While the information and opinions contained within have

been compiled from sources believed to be reliable, KWR

does not represent that it is accurate or complete and

it should be relied on as such. Accordingly, nothing

in this article shall be construed as offering a guarantee

of the accuracy or completeness of the information contained

herein, or as an offer or solicitation with respect to

the purchase or sale of any security. All opinions and

estimates are subject to change without notice. KWR staff,

consultants and contributors to the KWR International

Advisor may at any time have a long or short position

in any security or option mentioned.

|